Published

4 years agoon

Market Update for August 26

By Investdata Analysts

Nigeria’s equity market rallied at the midweek after demand for manufacturing and banking stocks helped the benchmark All-Share index close marginally higher for the seventh successive session on continued positive sentiments and low traded volume.

The bull-run showed a surprising level of resilience, on the back of increased buying interests in Stanbic IBTC, Vitafoam, PZ Cussons, UACN, Flour Mills, Guinness Nigeria, Guaranty Trust Bank , and FBN Holdings, among others. With high cap stocks on the rise as indicated by the positive market breadth, despite the seeming delay in the expected earnings reports of interim dividend paying banks.

The market and economy continued moving in opposite directions since the outbreak of the Coronavirus (COVID-19) pandemic late March, pushing the Nigerian Stock Exchange (NSE) to its 11-year low on panic selloffs before the rebound in April, as foreign investors repositioned their portfolios on low price attractions. The recent move by institutional or foreign investors to increase their stakes in different multinational companies is due to the prevailing low equity prices and difficulty in repatriating their dividend.

Investors are also keeping their eyes on crude oil price, which has recently rallied above $45 per barrel on the news of the hurricane in the Gulf of Mexico, and the continued easing of lockdowns across the globe that is triggering economic activities across many countries leading to the gradual restoration of normalcy. Also, the government is refocusing its agenda on education, health and power over the next three years, which may impact positively on healthcare and manufacturing companies, if public power supply improves, boosting production and supporting economic recovery and growth.

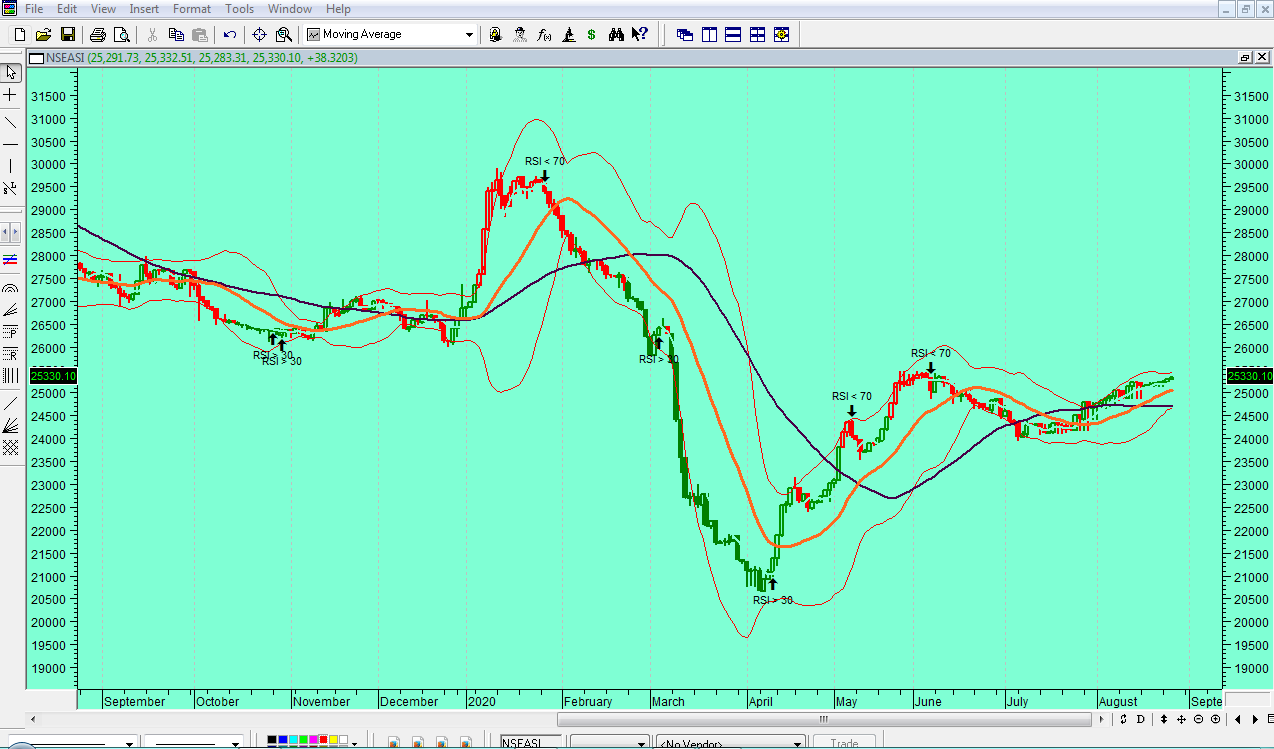

The positive momentum and sentiment for interim dividend paying banks and repositioning in consumer and industrial goods have kept the market in the uptrend, even when technical indicators and chart patterns show a double top formation and short-term overbought region that signals pullback and price correction ahead.

Meanwhile, midweek’s trading started on the upside before pulling back slightly at the mid-morning, before retracing up at midday, a situation that was sustain for the rest of the session on position taking in manufacturing stocks. This pushed the NSE index to intraday high of 25,332.51 basis points, from its low of 25,283.31bps after which the market closed at 25,330.10bps.

Midweek’s market technicals were positive and mixed, as volume traded was lower than the previous session with breadth favouring the bull on a strong buying pressure, as revealed by Investdata’s Sentiment Report showing 95% ‘buy’ volume and 5% sell position. Total transaction volume index stood at 0.85 points, just as the momentum behind the day’s performance remained strong, with Money Flow Index reading 72.88 points, from the previous day’s 72.78points, an indication that funds entered some stocks and the market.

Index and Market Caps

At the close of midweek trading, the composite index NSEASI gained 38.37bps, closing at 25,330.10bps, after opening of 25,291.78bps, representing 0.15% up, just as market capitalization inched by N20.02bn at N13.21tr, after opening at N13.19tr, also representing a 0.15% value gain.

To become a member, send ‘YES’ or ‘STOCKS’ to the phone numbers below. Take advantage of this service to buy right and sell right at the current market recovery ahead of Q3 earnings reporting season portfolio reshuffling and repositioning as we await an economic reform policy to stimulate and re-track the economy again.

Thursday’s upturn was due to value gains that impacted positively on the index’s as Year-To-Date loss, reducing it to 5.63%, while market capitalization YTD gain stood at N255.69bn, or 1.88% above the year’s opening value.

Mixed Sector Indices

Performance indexes across sectors were mixed, except for the NSE Insurance and Banking indices that closed 0.922% and 0.03% lower respectively, while the NSE Consumer Goods index gained 0.16%, followed by NSE Industrial goods with 0.02% up while NSE Oil/Gas was flat.

Market breadth was positive as gainers outnumbered losers in the ratio of 24:8, while transactions in terms of volume and value were mixed, even as traded volume dropped by 28.1% after investors traded 180.78 million shares compared to the previous day’s 251.34 million units. Transaction value rose by 16% to N1.36bn from N1.17bn the previous session. Volume was boosted by trades in Fidelity Bank, UBA, Access Bank, FBNH and Guaranty Trust Bank.

FTNCOCOA and NNFM were the best performing stocks, gaining 10% and 9.76% respectively to close at N0.22 and N4.50per share on market forces and improving earnings respectively. On the flip side, Cornerstone Insurance and Africa Prudential lost 9.69% and 6.67% respectively, closing at N0.56 and N4.20 respectively on profit taking.

Market Outlook

We expect the current trend to continue on profit taking and buying interests ahead of the interim dividends from Stanbic IBTC, GTB, Zenith Bank, Access Bank and UBA, that have kept the market above the 50-day moving average on a daily time frame. The mixed intraday movement is likely to persist as the month of August gradually winds down in the midst of window dressing, profit booking and investors repositioning their portfolios ahead of Q3 numbers.

This is also against the backdrop of the fact that the capital wave in the financial market may persist in the midst of relatively low-interest rates in the money market, high inflation, negative Q2 GDP of 6.1% and unstable economic outlook for 2020 as government and its economic managers are going front and back with mismatch polices and action.

Also, investors and traders are positioning in anticipation of interim dividend paying companies earnings reports, amidst the changing sentiments in the hope of improved liquidity and positive economic indices which may reverse the current trend.

We see investors focusing on portfolio adjustment and rebalancing by targeting companies with strong potentials to grow their dividend on the strength of their earnings capacity.

Again, the current undervalue state of the market offers investors opportunities to position for the short, medium and long-term, which is why investors should target fundamentally sound, and dividend-paying stocks for possible capital appreciation for the rest of the year.

Ambrose Omordion, Chief Research Officer, Investdata Consulting Limited