The Nigerian equities market started the week on a sour note as investors in the market lost a whooping N655.29 billion as a result of negative...

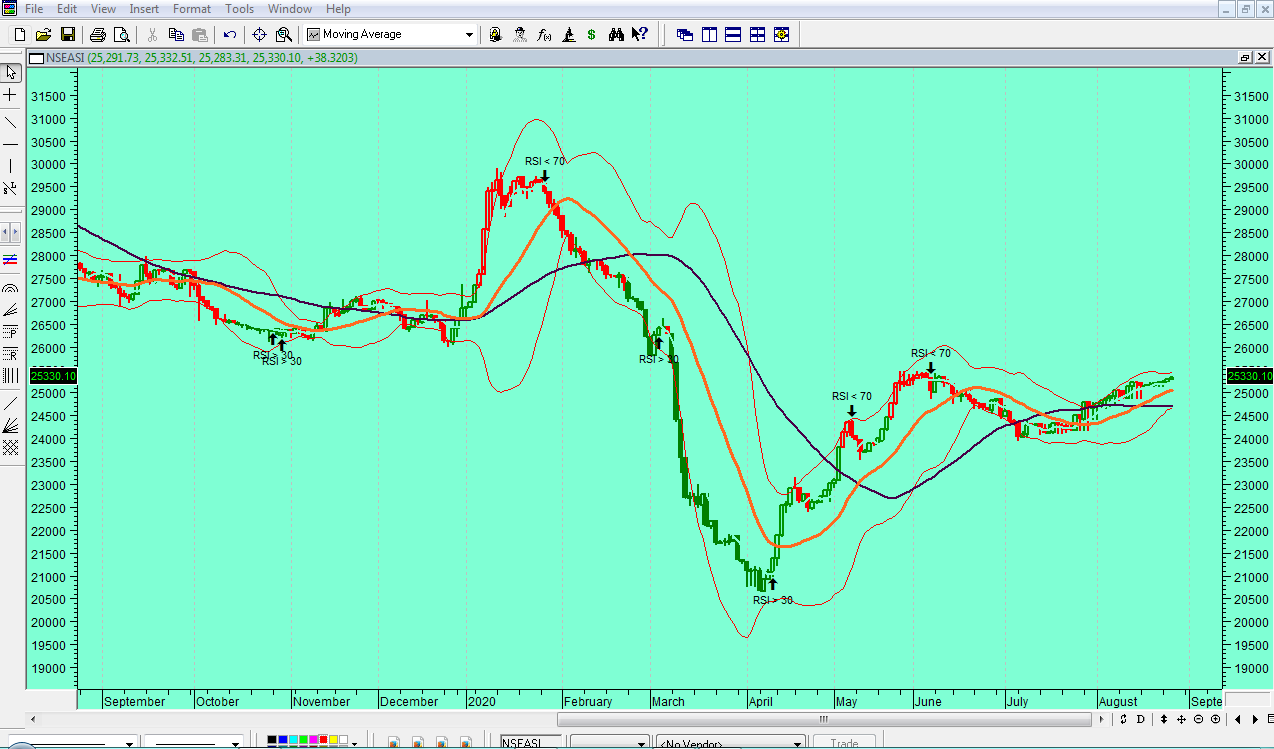

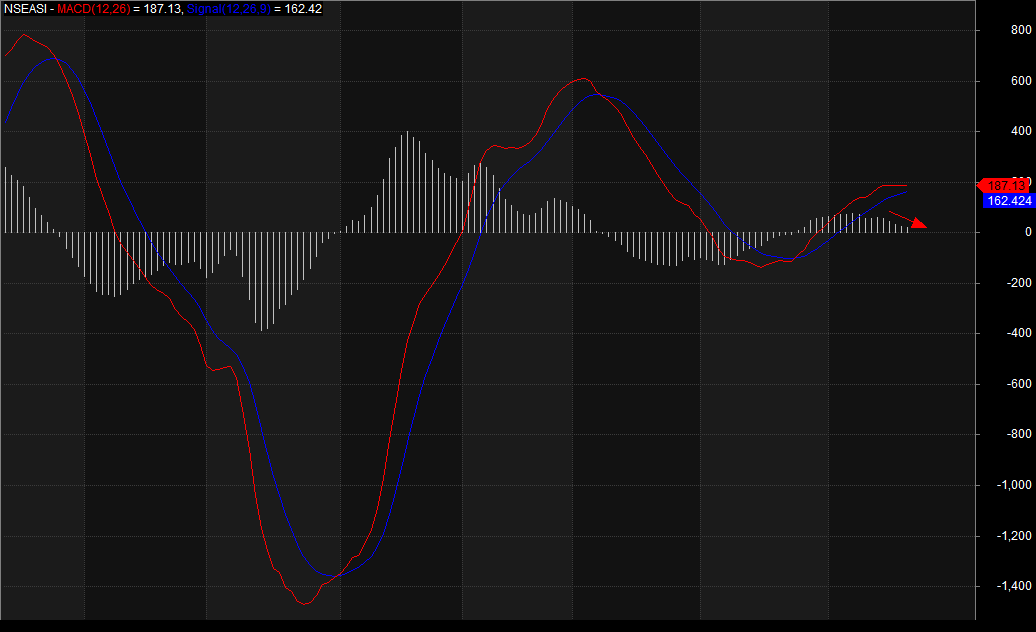

Market Update for August 26 By Investdata Analysts Nigeria’s equity market rallied at the midweek after demand for manufacturing and banking stocks helped the benchmark All-Share...

Rallies on equities at the Nigerian stock market sustained momentum on Wednesday as the market again advanced by 0.15 per cent to the delight of investors...

By Han Tan News flow has been relatively light this morning with the Dollar slightly bid against most of the G10 and mixed versus Emerging Market...

Market Update for August 20 By Investdata Analysts The nation’s equity market extended its bull transition on a mixed and volatile session at the end of...

Investors at the Nigerian stock market went home on Wednesday with a collective loss of N62 billion as the All Share Index (ASI) nosedived by -0.47...

The equities wing of the Nigerian capital market is resuming activities today Monday June 8, 2020 on N118 billion loss recorded by investors to close last...

African equity capital markets have collectively seen downward turn in the last decade albeit with an increase in participation domestic investors in the markets. This has...

UACN Property Development Company Plc (UPDC) has raised fresh N15.962 billion from the capital markets through right issue as part of its recapitalisation and structuring efforts...