Analyst Insight

NSE index slides, as investors seek defensive stocks, await MPC outcome

Published

4 years agoon

By Ambrose Omordion

Trading on the Nigerian Stock Exchange (NSE) last week was relatively calm and mixed as equity prices dropped on cautious buying among investors, who have adopted a wait-and-see attitude after the 2020Q2 earnings reporting season kicked off with United Capital’s numbers that beat market expectations. This was however not replicated by the financials from Union Home Real Estate Investment Trust which were abysmal, reflecting the impact of the Coronavirus (COVID-19) pandemic on the commercial real estate sector, among others.

Read Also:

It was a period of oscillating trends and negative sentiments, despite the fact that the losing momentum of the benchmark NSE All-Share index reduced, after resisting further decline and side trending on a less than average traded volume.

Nigeria’s Consumer Price Index for the month of June, according to the National Bureau of Statistics (NBS), shows that inflation hit 26-month high after 11 consecutive months to 12.56% from 12.40% year-on-year in May. The 16 basis points rise in the June inflation rate was primarily driven by the uptick in food prices. Food inflation rose by 14bps to print 15.18% YoY, from May 15.04%.

This was due to many factors, which were compounded by the COVID-19 pandemic and the insecurity in the country with the Boko Haram and herdsmen/bandits dislodging farmers in the north east and northwest of the country respectively. Others include decayed road infrastructure and the attendant high cost of transportation, even while the nation’s land borders remain closed since August 2019.

With inflation rate now above the monetary policy rate by 6bps ahead of Monday’s Monetary Policy Committee meeting, vis-à-vis additional factors such as the recent hike in the price of petrol, as well as the Naira devaluation to achieve a single exchange rate at N381.5 to the US$ will further put pressure on inflation rate as CBN and government implement their bailout plans and the 2020 revised budget.

Stock markets across the globe were mixed in the period under review as fear of a second coronavirus wave heightened in the midst of recovering economic data, expected vaccine, ongoing earnings season and oscillating crude oil prices. These have continued to drive the sectoral rotation and market performance.

As we have always noted, in any market situation there are opportunities, especially with the earnings season kicking off in the coming week, with the possibility of changing market momentum and action. You don’t have to be smart before you can make money in the stock market because the way it moves is always changing. As such, what you need is to think differently and educate yourself, using home study packs and videos, especially mastering the earnings season for profitable trading and investing in any market situation/cycle. That means we do not equate an “up” market with a “good” market and vice–versa. Markets present different opportunities to make money at different times but to manage risk diversification across assets class, sectors, region, and currency.

Movement Of NSEASI

Last week’s trading was an extension of the previous week’s negative sentiment as high cap stocks suffered losses, recording three session of decline.

Trading for the period started on a negative stance, losing 0.44% on selloffs, which continued on Tuesday as the NSE index lost 0.36% before rebounding slightly by the end of midweek’s session, gaining 0.06% on buying interests in telecoms stocks. This was extended to Thursday on increased demand for telecommunication giants- MTNN and Airtel Africa, recovering by 0.83%, before closing lower on Friday, shedding 0.17% as high cap stocks recorded value loss. This reduced the week’s cumulative loss to 0.08%, as against the previous week’s 0.12% loss.

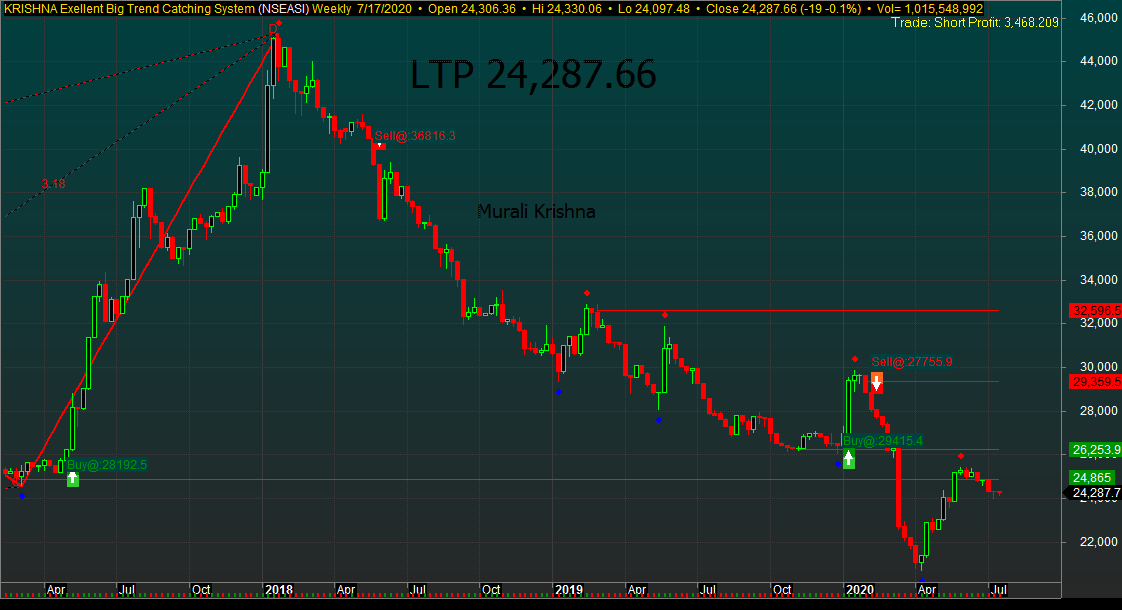

Specifically, the key performance index dropped by 18.70 basis points, having opened at 24,306.66bps, touching an intra-week low of 24,097.48bps, from its high of 24,330.06bps on mixed sentiments and cautious buying.

The index closed below its opening level at 24,287.66ps, just as market capitalization lost N9.75bn during the week, closing at N12.67tr, from the previous weekend’s N12.68tr, also representing 0.08% depreciation in value.

During the week, the share prices of NASCON Allied, Conoil, Smart Products and C&I Leasing were adjusted for cash dividends of N0.40, N2.00, N0.20 and N0.20 respectively proposed by their directors.

The advancers’ table for the period was dominated by low priced stocks, despite the fact that decliners were more in the ratio of 36:26, while the momentum behind the week’s performance was relatively strong, with Money Flow Index reading 68.38bps, up from 61.66bps in the previous week, despite the negative sentiments.

The composite NSEASI’s action side trended above the 20-Day Moving Average on a weekly chart, as it resisted further decline, while candlestick formation in the chart above signals pattern reversal, being a bullish hammer in the midst of momentum indicators on daily and weekly remaining mixed to suggest confirmation before jumping into the market. This is despite the weekly bullish MACD which has crossed the signal line, while sliding down and the NSE index resisting to breakdown the Fibonacci retracement line of 38.2, after testing it and thereafter retracing up, just as buy volume stood at 82%, and money flow index up at 68.38 points.

The Relative Strength Index for the period is looking down, reading 44.50 just as the momentum behind the market’s correction is increasing in the face of buying interests in some stock. This was just as mixed sentiments lingered on the ground that investors are discounting the happening in the economy and Q2 economic and earnings data, as portfolio repositioning continues at a time of global economic reset and fear of COVID-19 second wave in the second half, delaying the global economic recovery.

Impetus behind the NSE’s index movement on a daily and weekly chart have been mixed with the ADX reading 18.48 points from last week’s 18.98 points, on positive sentiments as revealed by Investdata’s Sentiment Report for the week, showing 82% ‘buy’ position and sell volume of 18% with the transaction volume index at 0.68.

Bearish Sectoral Indices

The sectoral indexes were bearish except for the NSE Industrial Goods which closed marginally 0.52% higher, while the NSE Banking index led decliners after losing 3.92%, followed by the NSE Consumer Goods, Oil/Gas and Insurance that closed 1.93% , 1.93% and 1.88% down respectively.

Activities during the week in terms of volume and value were mixed with volume traded inching up by 8.27%, as investors traded 1.02bn shares, up from the previous week’s 901.54m units, even as traded value dropped by 44.68% to N7.44bn, from N13.45bn in the previous week. The week’s volume was boosted by trades in financial services, oil/gas and consumer goods stocks, especially Sterling Bank, FCMB, FBN Holdings, Oando and Flourmills.

Cutix and NPF Microfinance were the best performing stocks during the period, after gaining 10.30% and 10.00% respectively, closing at N1.82 and N1.32 per unit on market forces. On the flip side, Linkage Assurance and Nigerian Breweries lost 14.89% and 11.89% respectively, closing at N0.40 and N30.00 per share on price adjustment for script dividend and profit taking respectively.

Market Outlook

We expect the mixed trend and volatility to continue as the MPC meets on Monday, with the half-year earnings reporting season kicking off in the midst of ongoing asset revaluation by fund managers and individual investors after one month of distribution, as selloffs gain momentum. This correction is, nonetheless, creating opportunities for short-term trading, using the value area called resistance and support level in the midst of earnings reporting season.

We cannot also rule out investors pricing in government’s inconsistent policies and weak macroeconomic data as the June Inflation report helps investors determine by how much it has thrown returns in most investment classes into negative yields. Already, inflation has risen close to the Central Bank of Nigeria’s benchmark Monetary Policy Rate (MPR) at 12.5%, even as the declining industrial productivity points to the reality of a recession.

The sectoral rotational wave will help investors cash in on low cap stocks and sectors that have suffered huge losses before now. Already investors are looking the way of healthcare, airline service providers, among sectors likely to be impacted positively in the much anticipated global and domestic economic reset.

Also, the possibility of continued funds inflow to low priced stocks is high, due to the higher yields and upside potentials, considering the low rates on offer in the money and bond markets. In the meantime, investors should also look out for developments around the implementation of the CBN’s funding plan for small and medium scale businesses.

Already, we notice that investors are taking position in healthcare and other defensive stocks likely to survive this meltdown, as seen in the increased trading in them, even as the global markets continue on the recovery path, with the gradual easing of the lockdown.

While discerning investors should prepare to take advantage of stocks revaluation to position for the medium to long-term, it is noteworthy that the Nigerian equity market is selling at a discount and therefore offers high upside potential.

Expect a pullback that will support the upside potential, especially with many fundamentally sound stocks remaining underpriced, and the dividend yield of major blue-chips continuing to look attractive in recent weeks, we expect speculative trading to shape the market’s direction, despite the seeming mixed outlook.

To position for the short to long-term, investors should target fundamentally sound, dividend-paying stocks, for possible capital appreciation in the coming months. Also, traders and investors need to change their strategies, because of the NSE’s pricing methodology, the CBN directives, and their impact on the economy in the nearest future.

Above is the market update for the week ended July 17, and outlook for July 20-24.

Ambrose Omordion, Chief Research Officer, Investdata Consulting Ltd.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to email a link to a friend (Opens in new window)

- Click to share on LinkedIn (Opens in new window)