Published

5 years agoon

By Ambrose Omordion

Thursday’s trading on the Nigerian Stock Exchange NSE) was bullish extending the gaining momentum of the previous session on long and short-term money flow into the telecommunication, healthcare and financial services sectors. This was ahead of the 2020Q2 earnings reporting season that kicked off with United Capital and Union Home Real Estate Investment Trust releasing their half-year score-cards to the market.

A snapshot of the report by Ucap for the period showed that it was impressive, with top and bottom lines growing by 37% and 16% respectively, translating to 32 kobo Earnings Per Share, from 28 kobo in the 2019Q2 to reflect the impact of the stock market rebound in the period under review and the impact of the fresh injection of fund by way of its bond. The result has shown that the investment company was not affected by the lockdown arising from the Coronavirus pandemic.

The real estate, especially commercial real estate, would likely be the first segment of the real estate market or business to enter the second phase of an extended collapse, because the pandemic has created an atmosphere where continuing operations for the retail side and restaurants, like many other business segments are virtually impossible to maintain.

The sectorial rotation and performance have been mixed and volatile in addition to the general market over the most recent period therefore the overall outlook is unstable. Already, the half-year earnings performance, the discovery of a Covid 19 vaccine, oil price recovery and effective implementation of government’s intervention policies and 2020 revised budget failed to give the much desired direction.

Focusing on diversifying your long trades in sectors that have strong upside potential, especially looking at the Telecoms and healthcare sectors which have shown the most strength, therefore, is key at this point. On Thursday, MTNN and Julius Berger edged toward a buy point on their earnings expectation as selloffs and profit taking hit the airline services providers.

Meanwhile Thursday trading started in the upside and oscillated throughout the session with buying interest in MTNN, Airtel Africa and banking stocks pushing the NSE’s All-Share Index to an intra-day high of 24,330.06 basis points, from its low of 24,114.59bps. Thereafter, the index closed higher than midweek’s level at 24,130.28bps on a positive breadth.

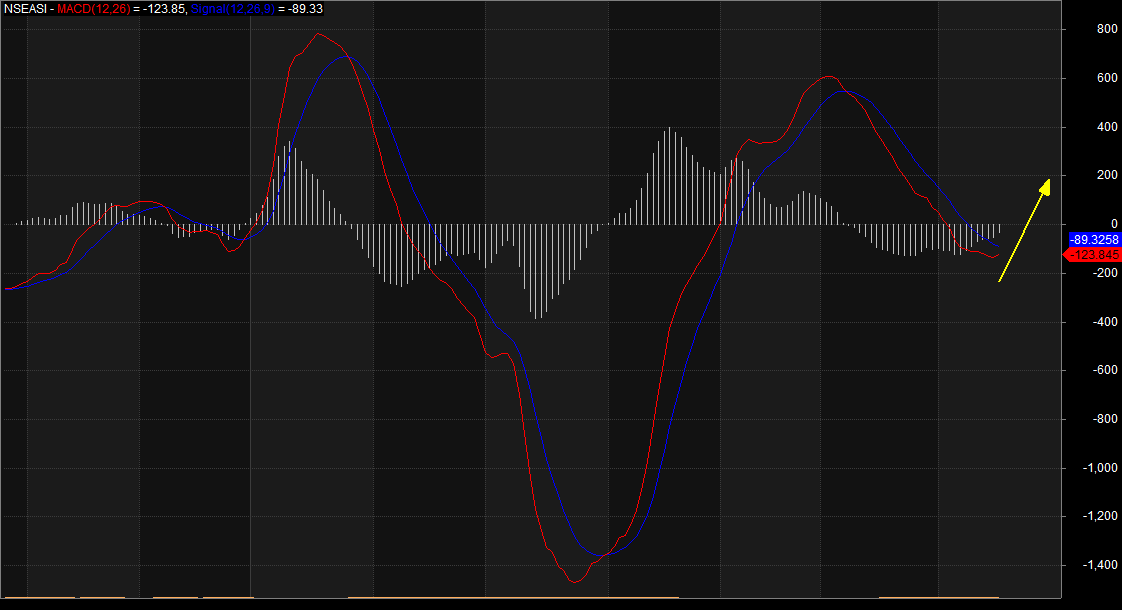

Market technicals for Thursday were positive and mixed on volume traded slightly lower than the previous session’s even as breadth favoured the bulls on a strong buying pressure as revealed by Investdata’s Daily Sentiment Report showing a ‘buy’ volume of 100%. Total daily transaction volume index stood at 1.02, just as the momentum behind the day’s performance stayed weak, with Money Flow Index reading 36.60 points, as against the previous 34.63ps, indicating that funds entered the market through some stocks.

Index and Market Caps

The NSEASI, at the close of Thursday’s trading, gained 199.90 basis points, closing at 24,330.06bps, after opening at 24,130.26bps, representing 0.83% growth, just as market capitalization was up N104.22bn, closing at N12.73tr, from an opening value of N12.59tr representing 0.84% appreciation in value.

If you are yet to sign up for Investdata’s Buy and Sell signal setup, don’t delay. We have just added another risk management feature and six categories of stocks to see you through in this changing market dynamics and economic uncertainties. These stocks are with double potentials to rally and protect your funds considering their current market prices.

To become a member, send ‘YES’ or ‘STOCKS’ to the phone numbers below. Take advantage of this service to buy right and sell right at this current market oscillation and earnings reporting season for portfolio realignment and positioning as we await an economic reform policy to stimulate and re-track the economy again.

Thursday upturn was due to value gains in stocks like Airtell Africa, MTNN, Guaranty Trust Bank, Zenith Bank, UBA, Dangote Sugar, Sterling Bank, Cadbury, and Ikeja Hotels. These impacted positively on the NSE’s benchmark index’s Year-To-Date, reducing the loss which dropped to 9.36%, just as the contraction in market capitalization YTD, dropped to N255.22bn, representing a 1.98% drop from the year’s opening level.

Mixed Sector indices

The sectoral indexes closed the day mixed, with the NSE Banking and Insurance index rising 1.01% and 0.08% higher respectively, while the NSE Consumers Goods index led the decliners after losing 0.46%, followed by NSE Oil/Gas which was down by 0.27%.

Market breadth turned positive as advancers outnumbered decliners in the ratio of 13:11, while transactions in volume and value terms were downby 0.46% and 43.75% respectively, after investors exchanged 207.4m shares worth N987.77m, from the previous day’s 208.21m units valued at N1.76bn. This volume was driven by trades in Sterling Bank, FBNH, Japaul Oil, Transcorp and Custodian Investment.

Ikeja Hotel and Presco were the best performing stocks for the day, after gaining 9.80% and 9.28% respectively, closing at N1.12 and N49.45 per share on market forces and the N2 per share dividend. On the flip side, Nahco and Unity Bank lost 9.88% and 9.84%, closing at N1.98 and N0.45 per share respectively on profit taking and selloffs.

Market Outlook

We expect the mixed trend to continue as the earnings season kicks off with United Capital and UHREIT filing their numbers ahead of the June inflation report, and the MPC meeting that has been scheduled to hold on Monday. But inconsistent government policies continue to dampen investor confidence ahead of the expectedly disappointing half-year corporate earnings reports. This is likely to support the wave of decline as pullbacks persist, creating new entering opportunities. Money flow index has continued to look down at 35.64, despite flowing from one sector to the other, seeking value in terms of low prices with high upside potentials.

This is just as economic recovery is threatened by the rising cases of the COVID-19 pandemic, ahead of the Q2 earnings reports season, which implies that opportunities are still available as sectoral rotation continues. Also, sectors that have suffered oversold, so far, offer attractive risk-reward buy-opportunities and outlook for considerable short, medium and long term investment.

For immediate liquidity or cash we advice that you trade low priced stocks with serious caution to avoid being trapped. However, the market’s high dividend yield continues to attract buying interests, as few audited and unaudited corporate earnings will hit the market, going forward. This is despite the likely continuation of selloffs. Investors are buying to increase their positions in undervalued stocks ahead of Q2 numbers. It is also against the backdrop of the fact that the capital wave in the financial markets may persist in the midst of relatively low-interest rates in the money market, high inflation, and unstable economic outlook for 2020.

Again, the current undervalued state of the market offers opportunities to position for the short, medium and long-term, which is why investors should target fundamentally sound, and dividend-paying stocks for possible capital appreciation going forward. Also, traders and investors need to change their strategies, because of the NSE’s pricing methodology, the CBN directives, and their impact on the economy in the nearest future.

Ambrose Omordion, Chief Research Officer, Investdata Consulting Limited