By Kaliba Bilala

“Most large complex financial institutions are global—at least in life if not in death.” – Mervyn King

When banks ran into trouble during the global financial crises of 2007–2009, regulators had a choice of either allowing failure or bailout. Governments chose the latter. We live in uncertain times where monetary policy actions taken, initially, to prop up domestic economies now threaten financial system stability due to the hikes in interest rates to curtail inflation.

A 2015 CFA Institute report, “Analysing bank performance: Role of comprehensive income”, shows why investors should not ignore information on other comprehensive income (OCI), a recondite subject. Comprehensive income comprises the income statement & the OCI statement. Both statements reflect the wealth created during a reporting period including the value added from operating & investing activities as well as gains or losses from re-measurements of assets & liabilities.

OCI line items include:

- Debt & equity securities re-measurement

- Derivatives used to hedge anticipated transactions

- Foreign currency (FX) translation gains or losses

- Pension obligation re-measurements

The OCI statement is used when there is a dual measurement for line items e.g., financial instruments. In these cases, fair value measurement is applied for balance sheet recognition whereas amortised cost measurement is applied for the income statement recognition related to these line items. Fair value & cash flow hedge re-measurements, which are interest rate sensitive, are predictive of future cash flows. It is also a signal of market volatility. These re-measurements have an impact on regulatory capital for banks in countries (e.g., Nigeria) that comply with Basel III requirements.

Article Continues after the infographics

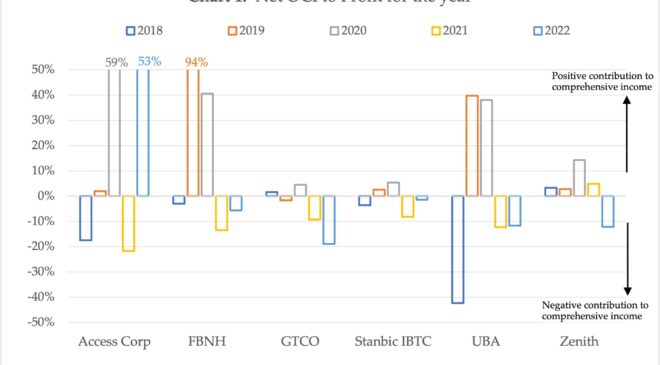

CHART 1: Net OCI to Profit for the Year

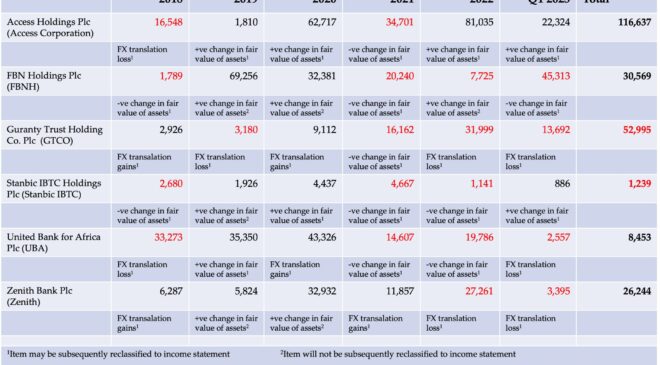

Observe Nigerian banks’ accounting of debt securities issued by the Government of Ghana after it defaulted on its debt. On 5 December 2022, Ghana launched a domestic debt exchange programme to tackle its economic crisis. This closed on 10 February 2023 with over 80% participation of eligible bonds, says the Ministry of Finance.

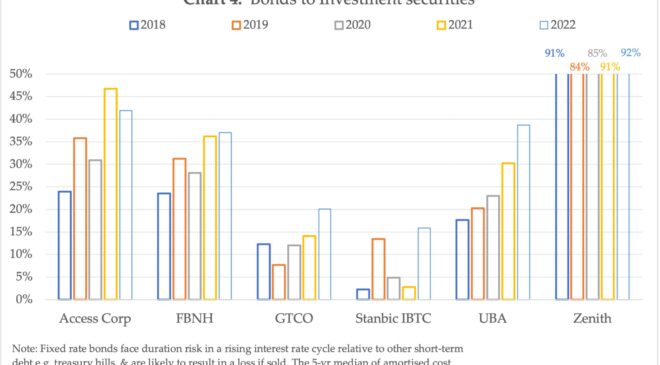

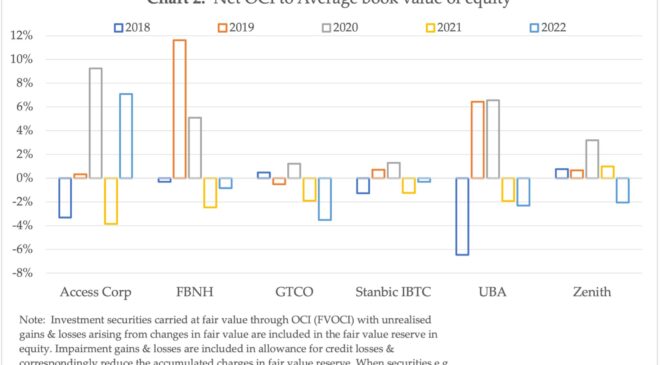

A review of OCI for select systemically important banks’ group accounts in Nigeria from 2018–2022 shows:

- Fluctuation between gains & losses in net OCI (see table 1).

- Contribution to corporate performance as indicated by comprehensive income (Profit for the year + net OCI) (see chart 1).

- Impact on book value of equity (see chart 2).

Moreover, discretion allows banks’ management to use investment securities portfolio to smooth regulatory capital as gains are more likely to be realised & reclassified to income statement than losses (see charts 3 & 4).

It is hoped that stakeholders realise how crucial it is to analyse OCI for its economic & informational content. As banks have assets & liabilities whose gains & losses are recorded in OCI. The OCI statement is where valuation changes in interest rate sensitive instruments are reported & likely to affect future cashflows.