By CSL Analysts

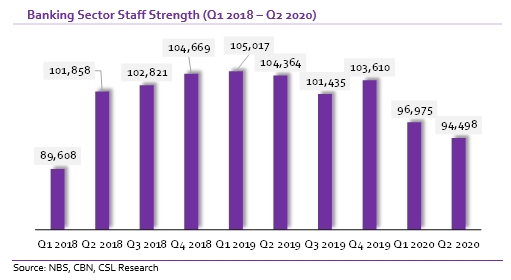

Yesterday, the National Bureau of Statistics (NBS) published the data on key banking sector statistics. According to the report, the total staff strength of the banking sector declined by 9.5% y/y and 2.6% q/q to 94,498 persons which represents a 9-quarter low. The biggest y/y declines were recorded in Contract staff (down 15.8% y/y to 38,942), Junior staff (down 5.6% y/y to 37,733) and Senior staff (down 1.8% y/y to 17,619).

On the other hand, Executive staff increased by 14.6% y/y to 204. On a q/q basis, all categories except Senior staff declined with Contract staff (down 5.4% q/q) leading while Executive staff (down 1.9% q/q) and Junior staff (down 0.8% q/q) followed. Senior staff increased by 0.3% q/q.

The decline in banking sector staff strength does not come as a surprise as the coronavirus outbreak in Nigeria led to many banks closing some of their branches across the country which may have led to some redundancies but more importantly the pandemic must have restricted expansion and new hiring.

Nevertheless, the y/y decline in the staff count of the Nigerian banking sector did not feed into lower Personnel expenses in H1 2020. For our 8 coverage banks, total Personnel expenses grew by 7.6% y/y to N227.5bn in H1 2020 from N211.4bn in H1 2019. The increase was largely driven by double digit growth in UBA (up 19.9% y/y) and Access (up 16.0% y/y).

In particular, Access concluded an acquisition which may have impacted H1 2020 personnel costs. For UBA, we reckon that the bank implemented an upward pay review in Q4 2019, thus the low base of H1 2019 was responsible to steep y/y rise in personnel cost.