Published

4 years agoon

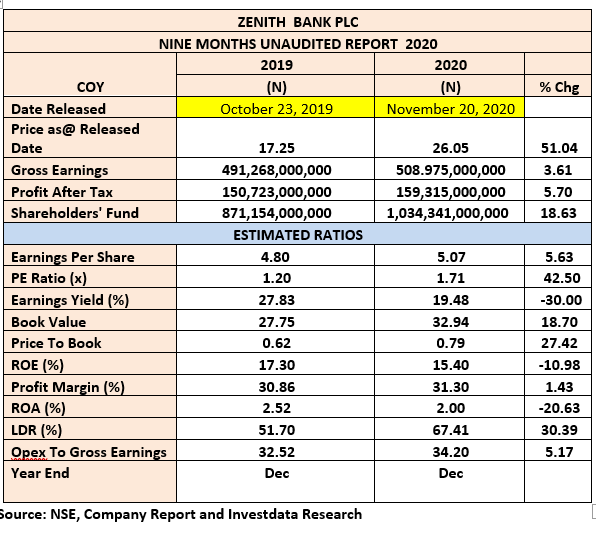

Last week, Zenith Bank Plc released its long-expected unaudited financials for the nine-month ended September 30, 2020, later than the released date of the 2019 scorecard, showing that earnings have grown consistently on quarterly and yearly bases over the years.

The bank has also sustained its culture of risk management that has kept impairment charges lower over the years, enhancing profit, besides the high asset quality and strong balance sheet that supports outstanding performance in a challenging environment. The result therefore points to the possibility of a high dividend payout at the end of the current financial year, as shown by the steady 10-year steady growth in Earnings Per share.

Source: Investdata Research, NSE, company data

The management’s determination to create value for stakeholders is evident in its earnings power and investment ratios, deposits with which it has grown loan and advances, and a Loan-Deposit Ratio of 67.41%, surpassing the 65% regulatory threshold. The bank’s N159.32bn bottomline during the period under review translated to N5.07 Earnings Per Share (EPS), compared to the N4.80 of 2019. The growth was driven by higher trading, fee and other incomes.

However, traders and investors have not reacted to the numbers as Zenith Bank’s share price continues to oscillate below the N27 per share price as of released date.

Gross earnings rose 3.61% from N491.27bn to N508.98bn, while net profit improved by 6%to N159.32bn, from N150.72bn in the corresponding period of 2019. The rally in market value for the period, reflected on the earnings yield, which dropped to 19.48% at released date, from 27.83% in 2019.

Operating cost inched up by 9.65%, while loan loss provision for the period grew by 37.51%, thereby significantly eating into the bottom line, despite which profit margin stood at 31.30%, a marginal growth from 30.86% in the 2019 corresponding period. Net Assets rose by 18.63% to N1.03tr, from N871.15bn, becoming the first listed company to cross the trillion Naira shareholders funds threshold.

Adjusted Price to Earnings ratio for the period was 1.71x, better than the 1.20x recorded in the similar quarter of last year, reflecting in the 51.04% price appreciation over the period. Book Value for the period stood at N32.94 per share, while Return On Equity dropped marginally to 15.4%, from 17.3% in 2019

Zenith Bank continues to enhance its capacity to drive investment and profit ratios, as shown by the nine-month EPS, a yield of 19.48% on the market as of released date. Retained earnings improved to N459.32bn, from N362.33bn in 2019, a pointer to the high possibility of an increased dividend payout at the end of this financial year.

Loan to Deposit Ratio is currently estimated at 67.41%; while Capital Adequacy Ratio remained robust at 21.5%, as against the 15% minimum stipulated by the CBN, even as the consistent growth of Book Value and high margin of safety remain encouragement and reason for excitement among discerning investors and traders.

Valuation

The bank’s current share price is considered very attractive at 1.71x earnings, just as its 2020 financial-year result upgraded guidance is indicative of the stronger performance from the board, especially as the numbers remain impressive. Meanwhile, at N32.94 each, Zenith Bank’s Book Value reveals its undervalued status, following which it can be considered fairly priced at N38 per share, which is a 48.43% discount to the current market value.

Analysts Opinion/Recommendations

Also, we expect earnings from trading and fee income to continue driving and supporting profit, going forward.

Consequently, we maintain our projection of full-year EPS of N6.70 and final dividend payout of N2.50 or more.

Traders and investors, no matter the investment goals, desirous of preserving capital, should look the way of this stock, even as its Q3 performance confirms our earlier upgraded guidance, after studying its quarterly results so far in the current financial year.

Investment in the stock for the next 90 days will beat any form of returns from other investment windows like treasury bills, bonds and fixed deposit. On the dividend equalization policy of the bank with growth in payout, we expect a better dividend yield at the end of the year and put a BUY rating on Zenith Bank

Technical View

Zenith Bank’s price action has remained bullish since April, after rebounding from a low of N10.85 on positive sentiment, improved liquidity and impressive financials that has formed a saucer chart pattern that supports an uptrend. The pullback has stayed within the up channel as the market reacts to the Q3 earnings news. RSI is reading 72.10 and money flow index is looking down, a sign that profit takers are still selling ahead of this week’s Monetary Policy Committee meeting, owing to investor concerns over the state of the Nigerian economy. It is worthy of note that the bank is trading above its shortest moving average of 14, 20 and 50.

Four-Year Performance (2016-2019)

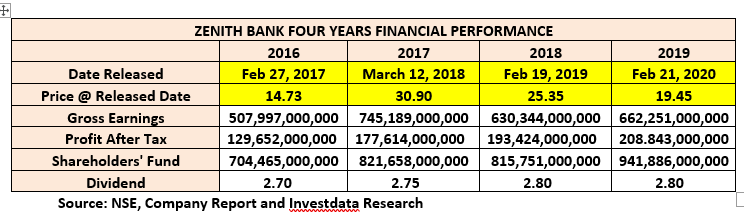

A critical look at the bank’s performance over the past four years shows a consistent improvement in the top and bottom lines, except for 2018 when there was a slowdown in the investment and profitability ratios. The high and low performance is revealed by the numbers in the tables below. Gross income for the period oscillated to reflect changes in the economy, moving from N508bn in 2016 to a peak of N745.19bn before falling in 2018 to N630.34bn, before rebounding in 2019 to N662.25bn.

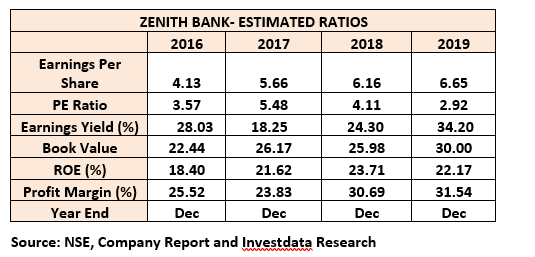

Profit level has constantly been on the uptrend in the four-year period, translating to a 61.1% growth at N208.84bn, from N129.65bn in 2016. Earnings Per Share remained strong and steady at N6.65 each, despite the level of heightened regulation in the industry and the unfriendly operating environment, especially with the high Monetary Policy Rate (MPR), tight liquidity, rising inflation rate, dwindling discretionary income, and falling Naira value.

The bank’s earnings capacity rose from 413 kobo in 2016 to 566 kobo in 2017, and then 616 kobo and 665 kobo in 2018 and 2019 respectively, despite the various headwinds in the banking industry during the period under review. Zenith Bank’s stable Earnings Yield movement is a plus, notwithstanding the decline from 28.03% in 2016 to 18.25% in 2017, after which it has maintained an uptrend ever since to 24.3% in 2018 and 34.20% in2019.

The bank’s risk management efforts are paying off as shown in the Non-Performing Loans ratio and improved profit margin that supports the steady growth in profit, dividend payout and impact on the economy through its social responsibilities efforts. Also, the bank has demonstrated some measure of doggedness in retail banking and other factors that continually support and drive profit.

Investors, on the other hand, have followed the outstanding performances of Zenith Bank over time, taking strategic positions especially given the inherent value, while creating wealth as investors smile to the banks on a bi-annual basis. Similarly, over the years, Book Value has grown in the same direction, from N22.44 per share in 2016, first to N26.15 in 2017, N25.98 in 2018, and N30.00 each on consistent earnings growth. This has also translated to improved Investor confidence, which is expected to support the price, especially as valuation tools place the bank’s stock at N38 per share.

_________________________________

Ambrose Omordion, Chief Research Officer, InvestData Consulting Limited

info@investdataonline.com

ambrose.o@investdataonline.com