Capital Market

Post-MPC Decision: Mixed trend ahead, as investors reshuffle portfolios for year-end

Published

5 years agoon

Market Update for November 24

By Investdata Analysts

Trading activities on the Nigerian Stock Exchange rebounded on Tuesday on the back of the Central Bank of Nigeria’s Monetary Policy Committee decision to retain all policy instruments unchanged, so as to drive economic output and hasten recovery. The rebound halted three consecutive sessions of losses on high buying pressure that resurfaced by early afternoon.

Read Also:

The rebound also came as the outgoing President of the United States, Donald Trump, finally conceded defeat, after weeks of stand-off, to give way for the transition activities of President-elect Joe Biden.

The MPC members ended their two-day meeting on Tuesday with a unanimous decision to retain all rates, restoring confidence to the stock market, and contributing largely to the recovery witnessed during Tuesday’s session.

In our opinion, the just released nine months financials of companies with December year-ends, should be the major investment guide at the moment, even as we also believe that movements in economic indicators/policies will sharply dictate market direction going forward. This is given the fact that the nine-month earnings season has ended, while the next major earnings season begins at the end of first quarter 2021, when companies begin to file their audited numbers for December 31 year-ends. We advise players to position right by combining fundamental, technical and sentiments while making their choices.

How to shop for stocks in this market in recovery will be discussed at our Invest 2021 Summit on December 5, for Traders & Investors, tagged: New Opportunities and new paths to profit.

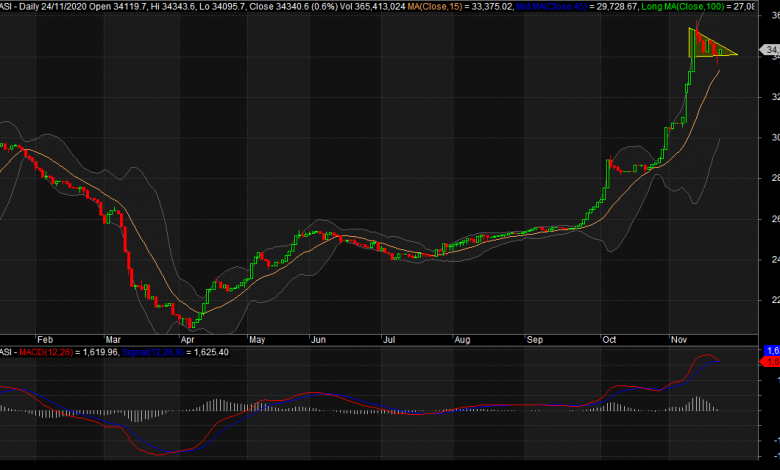

Tuesday’s trading started on a slight upside in the morning and was sustained throughout the session amidst buying interests across various sectors that lifted the NSE All-Share index to an intraday high of 34,343.56 basis points, from its lows of 34,095.69bps. Thereafter, it closed the session higher than the opening value at 34,340.56bps on a low traded volume.

The session’s market technicals were positive and mixed, with lower volume traded than previous day’s in the midst of breadth favouring bulls on a high buying pressure, as revealed by Investdata’s Sentiment Report showing 99% ‘buy’ volume and 1% sell position. Total transaction volume index stood at 0.73 points, just as impetus behind the day’s performance was relatively strong, as Money Flow Index read 72.28 from the previous day’s 72.08 points, an indication that funds entered some stocks and the market, halting profit taking.

Index and Market Caps

The key performance index of the NSE rebounded at the end Tuesday’s trading, after the news confirming the recession triggered panic selloff on Monday, with th NSEASI gaining 218.78bps. It closed at 34,340.56bps, representing a 0.65% rebound, after opening at 34,121.78bps, just as market capitalization retrieved N113.38bn at N17.94t, after opening at N17.84tr, also representing a 0.64% value appreciation.

Tuesday’s upturn was driven by price appreciations in medium and large cap stocks like Guaranty Trust Bank, Stanbic IBTC, United Capital, UBA, Access Bank, FCMB, FBNH, Dangote Sugar and Fidelity Bank, among others. This impacted positively on the Year-To-Date gain, as it increased to 27.94%, while market capitalization YTD returns stood at N4.98tr, representing a 38.47% growth above the year’s opening value.

Bullish Sector Indices

Performance indexes across the sectors were bullish, led by the NSE Banking that closed 2.18% higher, followed by the NSE Insurance which notched 2.02%; while the Consumer, Industrial Goods and Oil/Gas index were up by 1.36%, 0.06% and 0.03%.

Market breadth turned positive as advancers outnumbered decliners in the ratio of 26:16, while activity in volume and value terms dropped, with 365.41m shares traded at N4.69bn, compared to previous day’s 568.04m units worth N7.33bn. Volume was driven by trades in Zenith Bank, Transcorp, Guaranty Trust Bank, Access Bank and UBA.

United Capital Plc and Fidelity Bank were the best performing stocks, gaining 9.52% and 9.47% respectively to close at N4.60 and N2.66 per share on the back of market forces reactions to their impressive earnings. On the flip side, Eterna and Fidson Healthcare lost 9.98% and 9.81% respectively, at N4.15 and N4.87 per share, on profit taking.

Market Outlook

We expect a mixed trend, as players reshuffle their portfolios ahead of year end seasonality trends, as investors plan to make the best of the zero change in monetary policy tools, amidst the wait to see the further impact of recently deployed fiscal and monetary tools on the economy. This will continue to drive funds into Nigeria’s equity space as investors react to banks’ earnings which came mixed in the midst of recession news and the rise in November PMI to 50.2 points, from 49.6 points in October after six months of contraction according to the CBN. The NSE Index and Fibonacci revealed a ceiling of 35,814.18bps and 161.8%, that must be broken for current recovery moves to continue.

However, strong and faster recovery may continue, depending on market forces going forward. This will depend on how investor see the quality of Q3 score-cards presented, especially by the tier-1 banks, even as analyses of numbers released so far have helped repositioning of investors’ portfolios on the strength of sector and company’s performances.

The NSE’s index action and indicators are in divergent direction on a low traded volume and mixed sentiments.

Again, the current oscillating state of the market offers investors opportunities to position for the short, medium and long-term, which is why investors should target fundamentally sound, and dividend-paying stocks for possible capital appreciation in the rest of the year.

Ambrose Omordion, Chief Research Officer, InvestData Consulting LimiteD

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Telegram (Opens in new window) Telegram

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

You may like

Stocks: Tinubu’s Pro-Market Policies Spur N1.51 Trillion Profit

How Investors Stake N30bn on Stocks to Gain N703bn

Bargain Buying in MTN, Banking Stocks Lifts Equities by N284 Billion

Investors Lose N50.84bn on Shares

Investors trade N485.4 Billion worth of equities in Q2

Investors Lose N85.65 Billion as NGXASI Dips by -0.31