Finance

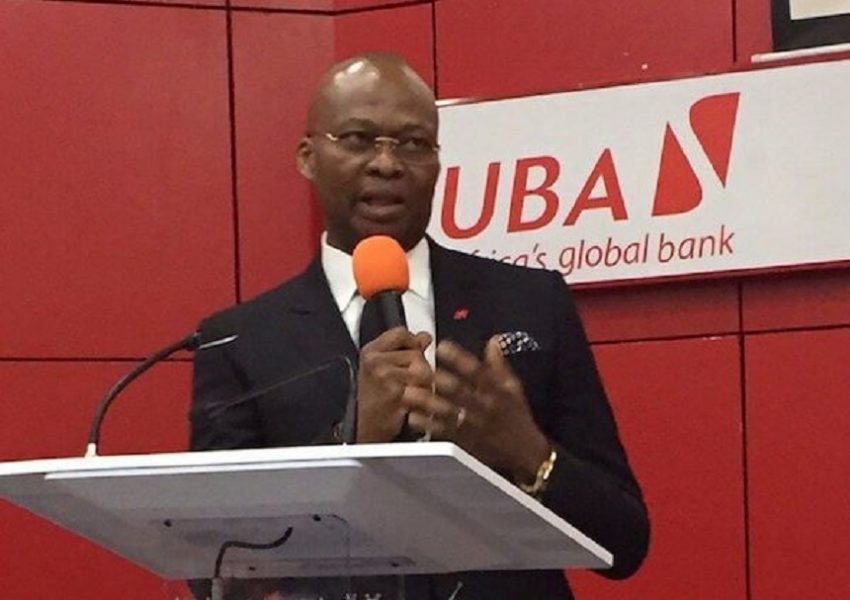

UBA on trajectory to beat 2021 targets, says GMD Uzoka

Published

4 years agoon

The group managing director and chief executive officer of United Bank for Africa (UBA) Plc, Kennedy Uzoka has expressed optimism that the bank is on its way to surpass projected targets at the end of the year.

He added that the bank’s focus on delighting its customers remains at the forefront of all its activities.

Read Also:

This is as he ascribed the impressive half-year results of the bank to its unending commitment towards delivering products and services aimed at meeting customers’ demands.

Uzoka said this during the Investors/Analysts Conference Call at the bank’s head office in Lagos, Nigeria, following the release of its results for the half year ended June 30, 2021.

Business Metrics reported that UBA delivered a 33.4 per cent appreciation in its profit before tax which rose to N76.2 billion as at June 2021, up from N57.1 billion recorded in the same period of 2020, translating to an annualised Return on Average Equity of 17.5 per cent as against 14.4 per cent a year earlier.

Profit after tax grew to N60.6 billion representing a significant rise by 36.3 per cent compared to N44.4 billion recorded in 2020, while gross earnings grew to N316 billion from N300.6 billion as at June 2020; a 5.1 per cent growth.

According to the GMD, this feat was recorded despite the challenging business and economic environment that emerged from the slow pace of activities following the global lockdown occasioned by the Covid-19 pandemic.

He said, “We are very committed to prudent and responsible growth of our risk assets, quality of our balance sheet and the overall health of the bank. We will continue to balance our growth appetite with the need to maintain very good healthy portfolio of our assets.

“Our customer first philosophy remains our guiding strategy. We want to assure you of positive customer experience for all our customers. In addition, we would like to deliver our banking services only from the standpoint of our customers. And indeed, as we say at UBA, our customers are our ultimate employers,” Uzoka explained.

Whilst expressing optimism that the Nigerian economy and the broader economy will continue to recover and rebound from the negative impact of the Covid-19 pandemic in the remaining quarter of 2021 and all the way into 2022, the GMD assured the investors and participants of the bank’s commitment to maintain professionalism and continue to ensure strict compliance with the rules and regulations guiding our operations in all our presence countries. “With the trusted commitment of all our great and wonderful employees, board and management, we will continue to match towards actualising our enterprise goals,” he noted.

UBA’s Chief Financial Officer, Ugo Nwaghodoh, who spoke on the bank’s significant geographical diversification across key economies in Africa and beyond, noted that UBA recorded impressive growth in interest incomes and net incomes, with steady growth in funding and deposits from customers.

He pointed out that even as the operating environment remains largely uncertain and volatile, despite marked improvement from Covid-19 induced macroeconomic stress, UBA will continue to build resilience through its geographically diversified business model to support headline earnings growth for the Group.

“We remain committed to our 18 per cent and 15 per cent respective RoAE and deposit growth guidance for FY 2021, as we continue to invest in growth opportunities across our geographies of operation, whilst managing capital and balance sheet prudently,” Nwaghodoh said.

United Bank for Africa Plc is a leading Pan-African financial institution, offering banking services to more than twenty five million customers, across over 1,000 business offices and customer touch points, in 20 African countries. With presence in the United States of America, the United Kingdom and France, UBA is connecting people and businesses across Africa through retail; commercial and corporate banking; innovative cross-border payments and remittances; trade finance and ancillary banking services.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Telegram (Opens in new window) Telegram

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

You may like

13-year-old Student Beats 7,000 others to Win N10m National Essay Grant

Top Nigerian Brands Hit $2.515Bn in Value as UBA Emerges Strongest Brand in 2025

UBA Surpasses N30 Trillion in Assets, Declares N767Bn Profit in 2024

UBA Reels Out Achievements at 75th Anniversary, Shares Long Term for Africa

Upswings as UBA Grosses N2.08TRN Earnings, Posts N757.7BN Profit in 2023

UBA Unveils ‘Scan to Resolve Complaint’ Portal to Enhance Customer Experience