Finance

Op-ed: Unlocking The Transformative Power of Mobile Money

Published

4 years agoon

Ashley Olson Onyango, Head of Financial Inclusion, GSMA

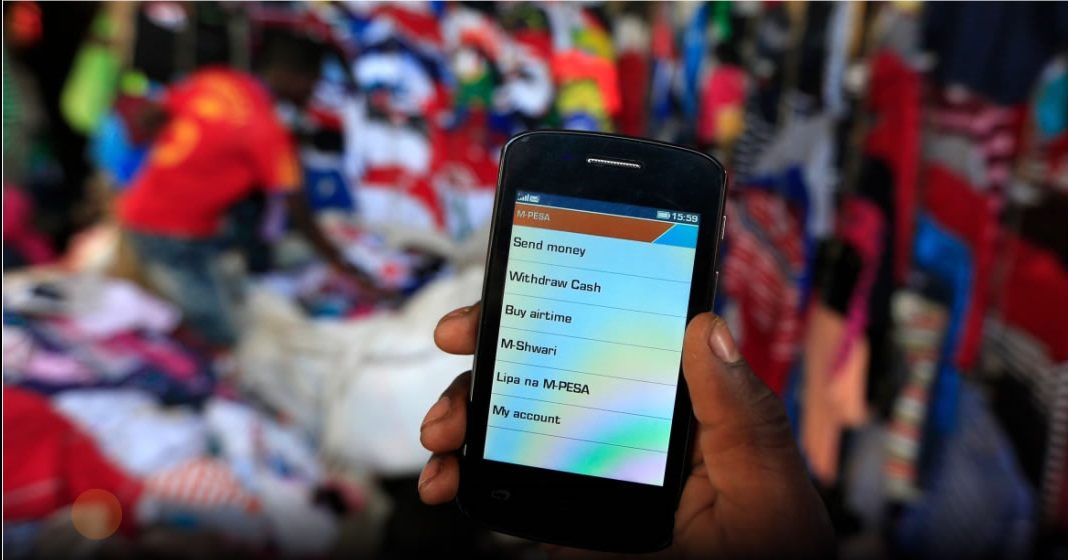

During the last decade, rapid digitisation has revolutionised the financial industry globally, through the advent of innovative services such as mobile banking apps or seamless transfer options. Driving this trend in low-and-middle-income countries, where over a billion people remain unbanked, mobile money has helped millions of unbanked people access financial services for the first time, tackling over-reliance on cash. Expanding from 134 million accounts back in 2012 to 1.35 billion last year – a more than tenfold increase – mobile money has evolved from a niche money transfer offering to a mainstream service that is financially empowering hundreds of millions around the globe. Since the early adoption and rapid growth of mobile money in East Africa, mobile money has branched out from its epicentre in sub-Saharan Africa to the rest of the world. Through this period, the industry has continued to innovate and has seen significant growth.

Read Also:

Over the past 10 years, we at the GSMA have been tracking the ever-growing presence of mobile money in our annual State of the Industry Report. This year’s decade edition reveals that the value of mobile money transactions reached a record $1 trillion in 2021. Although the use of mobile money has become a global phenomenon, African users remain a significant driver – accounting for 70% of the $1 trillion in transaction value. As a result, businesses and individuals alike have benefitted from this fast-paced digitisation of payments, unlocking access to more products and services, building financial resilience, and bringing about commercial opportunities. We explore key trends and prospects for the industry, its users, and other stakeholders.

From B2C to B2B: The Advent of Diversification

A key feature of the industry’s progress in the past years has been mobile money’s rapid diversification beyond its key traditional use case: person-to-person transactions (for example transferring money to family and friends). Most notably, 2021 saw the mobile money industry become instrumental in helping small businesses operate more efficiently and improve the customer experience. Mobile money-enabled merchant payments almost doubled in value from 2020, reaching a global average of $5.5 billion in transactions per month.

The urgency to digitalise all aspects of day-to-day life at the start of the pandemic catalysed the number of businesses accepting and receiving mobile money payments, thanks to efforts from mobile money providers and regulators. Since then, thousands of businesses, both physical and online, have started using mobile money to continuously drive prosperity and customer growth. Despite this growth, there is substantial room for growth in mobile money-enabled online payments as many merchant payments in Africa remain offline.

In 2021, new partnerships emerged between mobile money providers and payment technology companies such as Flutterwave to provide ‘Fintech-as-a-Service’. Iterations like this are already being made to enable more mobile money users to pay for online purchases. But there is still work to be done to help businesses embrace digital payments.

The Proliferation of Financial Inclusion

Since the onset of the pandemic, mobile money has helped women and other underserved communities in a variety of ways, from sending funds to families in need, to paying for essential bills and services. Ultimately, if women can access and use mobile money on par with men, they can flourish, bringing benefits to their households, as well as to the mobile industry and the economy.

Despite the progress made so far however, women in LMICs are still less likely than men to own a mobile money account, with considerable gender gaps in a significant number of mobile money markets (71% in Pakistan, 68% in India, 52% in Bangladesh, and so on).

But why exactly is this? Understanding the gender gap and barriers at different stages of the mobile money customer journey is critical to informing action: from mobile phone ownership to mobile money awareness, account ownership, and regular use. To begin with, women are seven per cent less likely than men to own a mobile phone, with some regions having an even greater gap. Beyond this, other barriers such as lack of awareness of mobile money and lack of perceived relevance, knowledge, and skills should be addressed to encourage equal access.

What is Next for Mobile Money on the Continent?

Looking back on the last year, the mobile money industry has seen significant growth, experienced vast diversification, and empowered financial inclusion. Behind the numbers and milestones within the mobile money industry are hundreds of millions of people participating in a more inclusive digital economy. But even so, more can be done to unlock the benefits of mobile money even further, driving not just financial access, but financial health.

Making mobile money widely available and more beneficial to all, particularly for the underserved, requires a holistic approach: appropriate corporate strategies and investments and conducive policy and regulatory changes, with a focus on all barriers along the customer journey. This year the mobile money industry hit a milestone number of transactions and with continued collaboration between businesses, governments, operators, and the mobile industry, the benefits of mobile money will continue to expand and reach the remaining unbanked populations – delivering lasting impact to the world’s most vulnerable.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Telegram (Opens in new window) Telegram

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

You may like

‘Cost of Data in Nigeria, Lowest in West Africa’

3.2 Billion People Wallowing in Broadband Internet Use Vacuum – GSMA

Google, Facebook, Netflix, Others Squeezing Telcos in $6.7 Trillion Internet Revenue – Report

MTN says its mobile money operation worth $6bn

560m youths to deepen Africa’s smartphone penetration – Report

$325,000 GSMA grants up for startups with assistive tech solutions