MARKETS AND ECONOMY

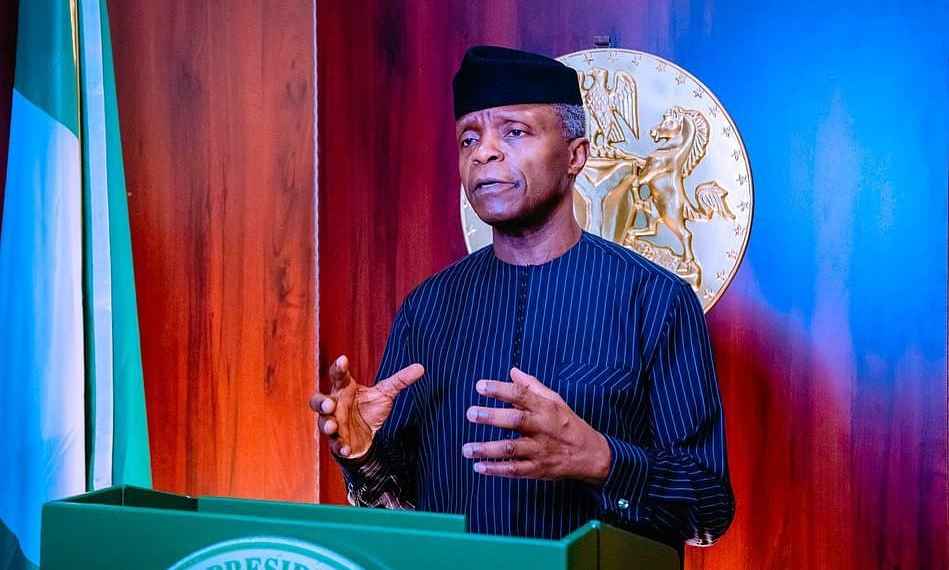

Why We Rejected Corporate Tax Treaty With 136 Countries – VP Osinbajo

Published

4 years agoon

The Vice President, Prof Yemi Osinbajo has on Wednesday disclosed the reason the Nigerian government pulled out of a corporate tax treaty with 136 countries that would see multinational companies getting a 15% tax waivers.

He said Nigeria rejected the tax agreement signed in October 2021 by 136 countries because “it would further compound the tax leakages in our tax system.”

Read Also:

The vice president made this known at the opening of the 24th Annual Tax Conference of the Chartered Institute of Taxation of Nigeria (CITN), themed “Global Disruption and Digitization: Implications for Socio-Economic Development.”

The countries agreed to the pact amid concerns that multinational companies were re-routing their profits through low tax jurisdictions to cut their bills. The measures were also part of the efforts to take advantage of the emerging digital economy.

However, justifying the reason the country pulled out of the deal, the vice president noted that for a multinational company with an annual turnover of $20 billion not to pay tax is an unimaginable injustice.

He said, “Another key thing that caught our attention is that 20 percent of this $20 billion must be generated in a country like Nigeria else, whatever business that enterprise does in Nigeria, we cannot subject it to any tax in Nigeria.

“Above all, we should not forget our tax law. The minimum turnover you require as a business in Nigeria to be able to register with the FIRS and pay taxes in Nigeria today is just N25 million.

And for somebody that makes less than 10 percent of $20 billion which I believe is about $2 billion in Nigeria and that person will not pay tax in Nigeria.

“I think that injustice is unimaginable, it is wrong and we will stand firm and say we will not accept it, and that’s why we rejected signing the agreement.”

Nigeria is the only country that we have and we should not be sensational in discussing these issue, we should not be emotional about it but let’s remain patriotic because if we sign this, then you can name all the multinationals operating in the country, in as much as their global turnover is not up to 10 percent of what they earn in the country, then they will stop paying taxes in this country.

“That is why we didn’t sign and we are not being arrogant about it, we are not trying not to move the way the world is going but the right thing should be done.”

The vice president however maintained that the endemic insecurity ravaging the country, infrastructural deficit and socio-economic problems can only be adequately addressed when the country’s revenue generation and taxation policies are effective and implemented.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Telegram (Opens in new window) Telegram

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn