Analyst Insight

NSE index rise, as window-dressing continues ahead of earnings season

Published

5 years agoon

By Investdata Analysts

Read Also:

The bull rampage on the Nigerian Stock Exchange (NSE) continued on Tuesday as positive sentiment boosted highly capitalized stocks causing a rally that pushed the benchmark All-Share index northward on improved buying interest. This reflected in the high traded volume, extending the eighth successive session of bull-run ahead of Wednesday, the last trading day for the third quarter and month of September.

Despite, the slowdown in gaining momentum as traders booked profit and reposition for the final quarter of this year, there is need for a review of Investment strategies and goals, to take advantage of rate cut and mismatch in economic policies to reposition in undervalued equities. In this markup phase of the NSE’s recovery, players must avoid emotions and personal opinions, but move with the market rather than against it.

We expect a brief or short correction after midweek’s trading and the public holiday declared on Thursday to celebrate Nigeria’s 60th independence anniversary, before the earnings start hitting the market. Already, companies have commenced their notification for closed period and broad meetings to approve their Q3 earnings reports.

Tuesday’s trading started on the downside which lingered into midday before rebounding on demand for high cap stocks that pushed the NSE index to an intraday high of 26,611.96 basis points, from its low of 26,427.58bps, before closing higher at 26.611.96ps on a positive breadth.

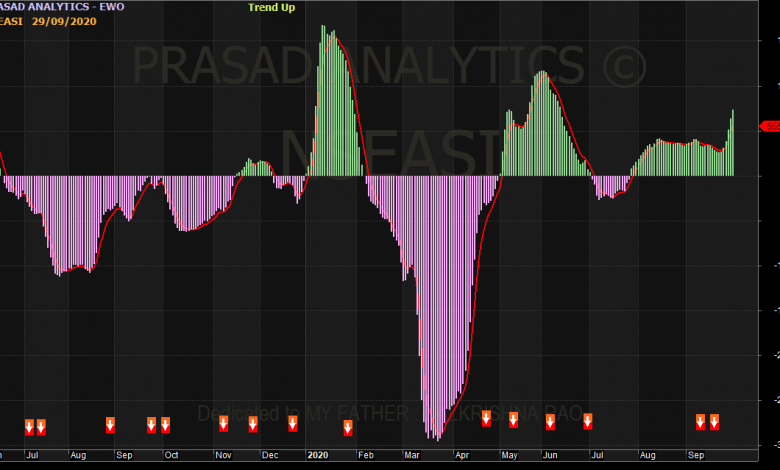

Market technicals were positive as transaction volume was higher than the previous session on positive breadth and strong buying pressure, as revealed by Investdata’s Sentiment Report showing 100% ‘buy’ position. Total transaction volume index stood at 1.65 points, just as energy behind the day’s performance remained strong, with Money Flow Index reading 82.57 points, from the previous day’s 74.74 points, an indication that funds are entering the market.

Index and Market Caps

The composite NSEASI gained 104.12bps, closing at 26,611.96bps, after opening at 26,507.84bps, representing 0.39% gain, while market capitalization rose by N54.41bn to N13.91tr after opening at N13.85 trillium, also representing 0.39% value gain.

Tuesday’s upturn resulted from the increased demand for stocks like MTNN, BUA Cement Seplat, Guranrty Trust Bank, Zenith Bank, BUA Cement, Dangote Sugar, Africa Prudential, Aiico and WEMA. This impacted positively on the index, reducing Year-To-Date loss to 0.86%, while market capitalization YTD gain rose to N949.42bn, representing 6.91% gowth over the year’s opening value.

Bullish Sector Indices

All the sectorial indexes performance index were bullish, led by the NSE Industrial Goods which closed 0.83% up, followed by the Banking, 0.40%, as well as Oil/Gas, Insurance and Consumer goods that closed higher by 0.26%, 0.53% and 0.26% respectively.

Market breadth was positive as advancers outnumbered decliners in the ratio of 16:14, while activities in volume and value rose as investors crossed 413.1m shares worth N4.53bn, from the previous day’s 336.83m units valued at N4.03bn. driven by trades in Zenith Bank, Sterling Bank, UBA, FBNH and FCMB.

Wema Bank and Aiico Insurance were the best performing stocks, after gaining 7.50% and 6.3% respectively, closing at N0.57 and N0.84 per share on the back of low price attractions and market forces. On the flip side, eTranzact and Cornerstone Insurance lost 10% and 8.5% respectively, closing at N2.35 and N0.65 respectively on profit taking.

Market Outlook

We expect profit taking in the midst of continued positioning ahead of the quarter-end window dressing and corporate earnings season, despite the negative macroeconomic indices. This is given the further crash in money market rates, while inflation is at 13.22%, worsening the negative returns on many investment windows.

The mixed intraday movement is likely to persist as we cross to October in the midst of expected profit booking, as well as the mismatch of economic policies and negative macroeconomic indices. This is also against the backdrop of the fact that the capital wave in the financial market may persist in the midst of relatively low-interest rates in the money market, high inflation, negative Q2 GDP of 6.1% and unstable economic outlook for the rest of 2020 as government and its economic managers are going front and back with mismatch polices and implementation.

Also, investors and traders are positioning amidst the changing sentiments in the hope of improved liquidity and positive economic indices which may reverse the current trend.

We see investors focusing on portfolio adjustment and rebalancing by targeting companies with strong potentials to grow their Q3 earnings and dividend on the strength of their earnings capacity as the year last quarter is at the corner.

Again, the current undervalue state of the market offers investors opportunities to position for the short, medium and long-term, which is why investors should target fundamentally sound, and dividend-paying stocks for possible capital appreciation for the rest of the year.

Ambrose Omordion, Chief Research Officer, InvestData Consulting Limited

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Telegram (Opens in new window) Telegram

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

You may like

ANALYSIS: Stock Trading in May Leaves Investors N1.8tr Richer, But June Outlook Dicey

Local Bourse Remains Negative as Market Cap Settles at N26.753 trillion

Investors lose fresh N185bn as bears rule local bourse

Investors lose N87bn as NSE resumes from Easter holidays

Bears stage comeback as stocks shed N157bn in four days

Bulls stage comeback with N199bn gain on Dangcem, MTN, Stanbic, other stocks