Finance

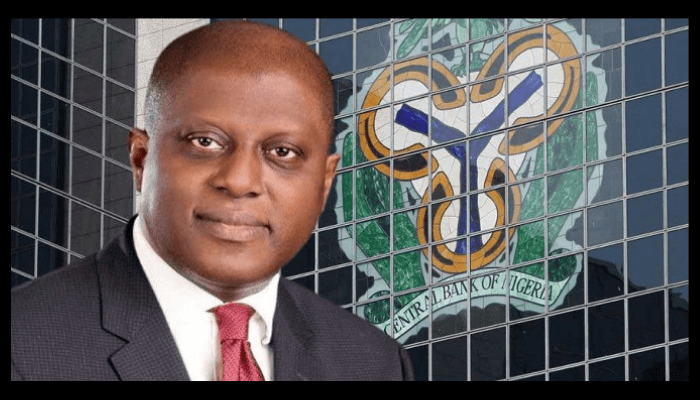

CBN Withdraws Cybersecurity Levy Circular after FG’s Suspension

Published

2 years agoon

The Central Bank of Nigeria (CBN) has withdrawn its earlier circular directing banks to implement a controversial 0.5% cybersecurity levy on electronic transactions.

The decision of the apex bank to withdraw the circular followed the public outrage that trailed the announcement of the policy two weeks ago and the suspension of the levy by the Federal Government last week.

Read Also:

The CBN in its latest circular dated May 17, 2024, referred to the earlier May 6, 2024 circular and advised financial institutions that the initial circular on implementing the cybersecurity levy “is hereby withdrawn”.

The CBN’s latest circular was co-signed by its Director of Payments System Management Department, Chibuzo Efobi; and his counterpart at the Financial Policy and Regulation Department, Haruna Mustafa.

BUSINESS METRICS reported that in its initial circular dated May 6, 2024, addressed to all deposit money banks, mobile money operators, and payment service providers, the apex bank directed the deduction of the levy to be remitted to the National Cybersecurity Fund (NCF), administered by the Office of the National Security Adviser (ONSA).

The development sparked wild outcries with labour unions threatening actions and pressure groups faulting the timing of the levy implementation amidst the cost of living crisis exacerbated by rising inflation.

The Federal Government subsequently suspended the controversial cybersecurity levy on May 14, 2024.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Telegram (Opens in new window) Telegram

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

You may like

Nigerian Banks Set New Target to Respond to Frauds

NCC, CBN Introduce 30-Second Refund Rule for Failed Airtime and Data Purchases

Banks’ N1.96Trn Black Hole: Who Took the Loans, Who Defaulted, and Why the Real Economy Suffers

How Policy Missteps Weigh Down Nigeria’s Fragile Banking Giants

Nigeria at 65: A Nation Still Waiting for a Banking Revolution

Nigeria’s Banking Woes: How One South African Bank Outvalues an Entire Industry