Digital Assets

CBN says Transactions on eNaira platform free for 90 days

Published

4 years agoon

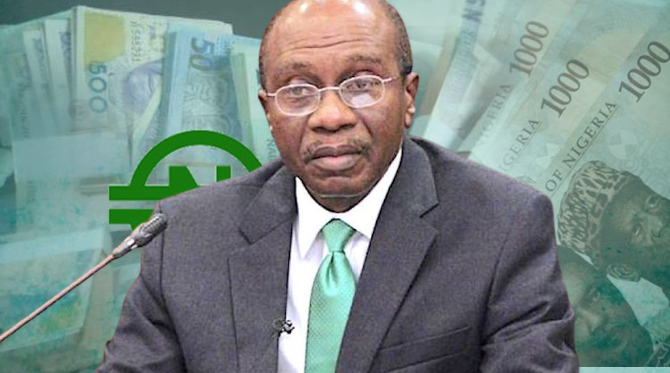

The Central Bank of Nigeria (CBN) has said that all transactions conducted on the newly launched digital currency platform, eNaira will be free for 90 days.

The bank, however, stated that it will revert to its guide on applicable charges by banks and other financial and non-financial institutions at the end of the stated period.

Read Also:

The apex bank disclosed this in the framework titled, ‘eNaira Circular and Guidelines’ released on Monday following the launch of the Nigeria’s central bank digital currency by President Muhammadu Buhari.

The CBN said, “The charges for transactions that originate from the eNaira platform shall be free for the first 90 days commencing from October 25, 2021, and then revert to applicable charges as outlined in the Guide to Charges by Banks, Other Financial and Non-bank Financial Institutions.”

The apex bank noted that Electronic Funds Transfer below N5,000 is charged N10; N5,001 – N50,000 is charged N25 and for above N50,000, a N50 charge is associated.

The apex bank also said phone numbers without verified National Identification Number (Tier 0) will have a daily transaction limit of N20,000, while the maximum that the account can hold is N120,000.

For phone numbers with verified NIN or Tier 1, CBN said they have a daily transaction cap of N50,000 and a maximum balance of N300,000.

Tier Two accounts will have access to a daily transaction of N200,000, while N500,000 is the maximum balance that can be held.

The Tier 3 account holder can transact a maximum of N1m daily, while the Maximum balance it can hold is N5m.

However, the CBN noted that merchant accounts have access to unlimited transactions.

According to the Bank, merchants are duly accredited individuals and non-individual (corporates) authorized to conduct business in Nigeria.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Telegram (Opens in new window) Telegram

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

You may like

CBN Recognises SystemSpecs, Others for Promoting eNaira

Crypto Enthusiasts Unimpressed By N8bn Turnover On eNaira Platform

CBN Lines Up Celebration Events as eNaira Clocks 1

CBN Launches e-Naira Code in Kano

CBN Commends Remita for Pioneering Usage of eNaira

33.4m Nigerians trade crypto as CBN’s eNaira suffers neglect