Featured

Global fintech lending on 25% growth to hit $335bn by 2021

Published

5 years agoon

- Lending by fintech to grow 9.1%

- SMEs’ search for fund driving momentum

___________________________________

Although traditional banks and credit suppliers still hold the largest market share for consumer and business loans, recent years have witnessed considerable demand for fintech lending.

Read Also:

With millions of SMEs searching for necessary financial backing to support their businesses amid the COVID-19 pandemic, 2020 witnessed a new rise in the number of these alternative loans.

According to data presented by BuyShares.co.uk, the entire fintech lending industry is expected to grow 9.15 per cent year-over-year to $291.5 billion in 2020.

The increasing trend is set to continue in 2021, with the transaction value of the unified market jumping by 25 per cent to $335 billion value.

Business Peer-to-Peer Loans to Hit $241.5bn Value in 2021

Consumer and business loans in the Fintech space are offered through lending platforms, connecting borrowers to lenders, without the need for a high street bank.

Sophisticated computer algorithms make lending decisions in minutes instead of days, enabling a much easier and quicker loan application process.

These alternative lending platforms also provide lower rates to borrowers as well as higher rates to lenders.

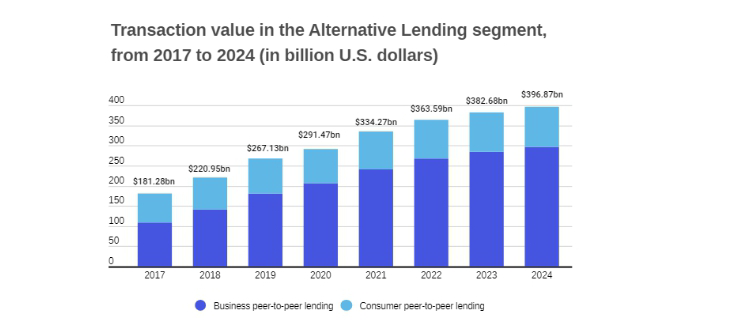

In 2017, the global fintech lending market was worth $181.2 billion, revealed the Statista Digital Market Outlook. By the end of 2019, the transaction value surged to $267.1 billion, a 47 per cent jump in two years.

Statistics show the global fintech lending industry’s value is expected to increase by $24.3 billion by the end of 2020 and hit a total of $291.4 billion.

As the market’s leading segment, business peer-to-peer loans have witnessed a 14 per cent YoY growth in 2020, with the transaction value rising from $180.8 billion to $206.12 billion.

By the end of 2021, the cumulative value of alternative loans to small and medium-sized companies is set to jump over $241.5 billion.

However, statistics indicate the COVID-19 crisis triggered a slight downsizing trend in the consumer peer-to-peer lending segment, with the combined value of loans falling by 1.2 per cent to $85.3 billion in 2020.

Nevertheless, the Statista survey revealed this figure is expected to rise by 8.6 per cent to $92.7 billion in 2021.

China’s Fintech Loans Rise, the US Market Dropped 15 per cent YoY

Regionally, China is the largest fintech lending industry globally, with an 86 per cent market share.

The country has been hugely affected by increased government regulation in recent years, which led to an enormous drop in the number of lending platforms and loans.

Nevertheless, the Statista survey revealed the Chinese alternative lending market rose by 13 per cent year-on-year to $251.87 billion transaction value in 2020.

This figure is expected to jump over $290 billion by 2021.

On the other hand, as the world’s second-largest fintech lending market, the United States has witnessed a drop in the number of alternative loans.

In 2019, the combined value of the business and consumer peer-to-peer loans in the United States amounted to $32.5 billion. Over the last twelve months, this figure slipped 15 per cent to $27.59 billion.

Far behind the two leading markets, the United Kingdom ranked as the third-largest alternative lending industry globally, with $3.91 billion transaction value in 2020.

Switzerland and Italy follow with $1.36 billion and $731 million, respectively.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Telegram (Opens in new window) Telegram

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn