Capital Market

PSB licences: Euphoria in MTN, Airtel drives equities to N646bn weekly gain

Published

4 years agoon

Recent announcements by MTN Nigeria and Airtel Africa on acquisition of payment service bank approval in principle has spurred excitement at various quarters but at the local stock market, the excitement was capped with massive profit for investors.

Given their positions as second and third most capitalized securities at the Nigerian Exchange Limited (NGX), MTN and Airtel were leading forces in a N646 billion profit posted by the market to close week positive despite flirting with the bears for three of the five trading days.

Read Also:

Specifically, strong buying interest in AIRTELAFRI and MTN led to 12.8% and 8.8% in their respective share prices due to the euphoria that greeted the announcement of Payment Service Bank (PSB) licence approval by the Central Bank of Nigeria (CBN)

Consequently, the NGX All-Share Index and Market Capitalization appreciated by 2.95 per cent. While the stock index added 1,238.51 points to close at 43,253.01, aggregate value of the equities market soared by N646 billion to close at N22.572 trillion.

Across sectors, the Banking index fell by 1.3%, Insurance dipped 2.2%, Oil and Gas by 0.7% while the Consumer Goods index which advanced by 0.6% index was the sole gainer. The Industrial Goods index closed flat.

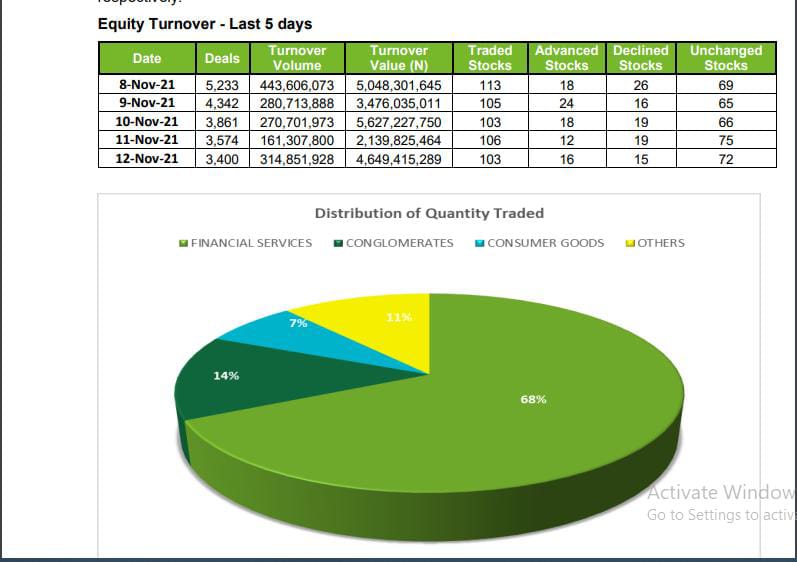

Trading activity levels were stronger than in the prior week, as trading volumes and value grew by 2.4% week-on-week and 69%, respectively.

A total turnover of 1.471 billion shares worth N20.941 billion in 20,410 deals were traded during the week by investors on the floor of the Exchange, in contrast to a total of 1.428 billion shares valued at N12.373 billion that exchanged hands previously in 23,987 deals.

The Financial Services Industry (measured by volume) led the activity chart with 996.555 million shares valued at N10.279 billion traded in 10,565 deals; thus contributing 67.74% and 49.09% to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 203.251 million shares worth N1.204 billion in 834 deals, while the third place was Consumer Goods Industry, with a turnover of 105.410 million shares worth N3.217 billion in 2,789 deals.

Meanwhile, FBN Holdings Plc, Sterling Bank Plc and UACN Plc pumped the volume for the week with collective traded 519.011 million shares worth N4.057 billion in 1,787 deals, contributing 35.28% and 19.37% to the total equity turnover volume and value respectively.

In the Exchange Traded Funds (ETFs) segment of the market, investors traded 23,297 units valued at N792,386.34 in 34 deals compared with a total of 252,857 units valued at N3.830 million that exchanged hands the previous in 31 deals.

Higher momentum was recorded in the bond market of the local bourse with as investors staked N60.795 million on a total of 56,655 units in 26 deals. This is higher than N33.332 million they previously bet on 32,626 units in 16 deals.

In their outlook, analysts at Cordros Capital expect investors to trade cautiously whilst taking positions in stocks with attractive dividend yields ahead of 2021 Full Year dividend declarations.

They added, “In addition, we believe the outcome of the bond auction scheduled to hold during the week will also shape market sentiments. Notwithstanding, we advise investors to take positions in only fundamentally justified stocks as the unimpressive macro story remains a significant headwind for corporate earnings.”

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Telegram (Opens in new window) Telegram

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

You may like

First HoldCo Plc Grows Earnings to N3.4 Trillion, Profit Declines on Heavier Impairment Charges

IMPACT: NGX Group, Lagos State and HEI Expand Project BLOOM to Alimosho

MTN’s MoMo PSB Expands Cross-Border Transfers to More African Countries

Nigerian Banks Set New Target to Respond to Frauds

Equities Investors Gain N3.84 Trillion in First Full Trading Week of 2026

NCC, CBN Introduce 30-Second Refund Rule for Failed Airtime and Data Purchases