Markets

Nigeria Takes Hunt for Global Capital to New York’s Nasdaq

Published

11 months agoon

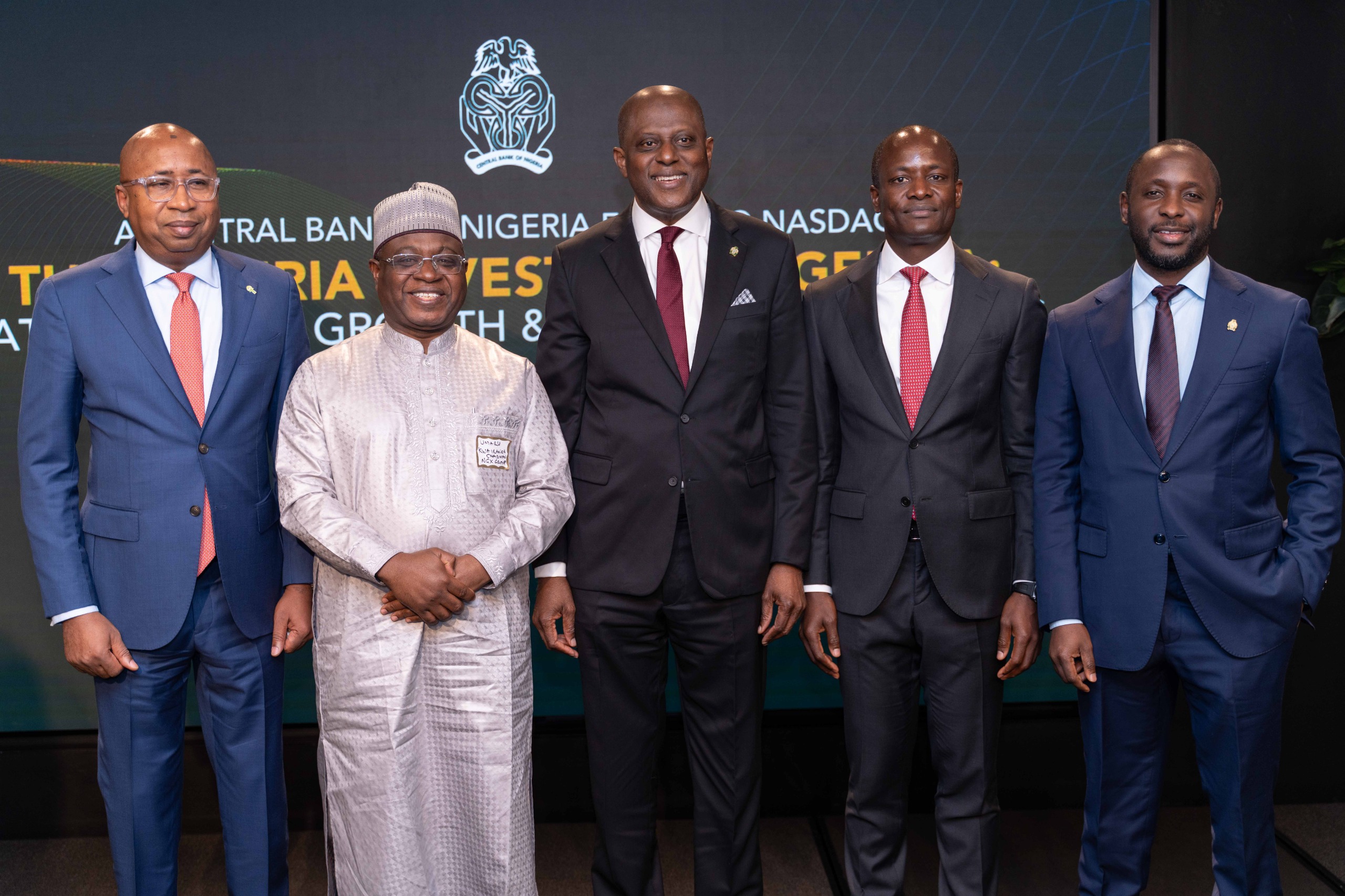

In a strategic push to attract global capital and reaffirm investor confidence, Nigeria’s top financial leaders showcased the country’s reform-driven economic agenda at a high-profile investment forum held at the Nasdaq MarketSite in New York on Thursday.

The event—jointly organised by the Central Bank of Nigeria (CBN), Nigerian Exchange Group (NGX Group), JPMorgan, and the African Private Capital Association (AVCA)—brought together leaders from the Nigerian diaspora, major global investment institutions, and multinational executives.

Read Also:

The gathering offered a compelling platform for dialogue on Nigeria’s evolving economic landscape and its readiness to embrace foreign direct investment.

CBN Governor Olayemi Cardoso headlined the event with a fireside chat alongside Nobel Prize-winning economist Dr. James Robinson. Cardoso outlined the apex bank’s commitment to disciplined monetary policy, market-oriented reforms, and enhanced transparency—measures aimed at creating a stable and investor-friendly financial environment.

He emphasized the importance of close collaboration between regulators like the CBN and market operators such as NGX Group, calling such synergy vital for building a resilient financial system and mobilizing long-term capital.

Providing further insight, Muhammad Sani Abdullahi, CBN’s Deputy Governor of Economic Policy, gave a detailed presentation on Nigeria’s financial transformation and recent foreign exchange (FX) policy reforms. His session set the stage for a high-level panel discussion titled “Repricing Nigeria: Assessing the Scope for Sustained Change.” Participants included senior executives from JPMorgan Chase, Standard Chartered, Citi, and Jadara Capital Partners.

Temi Popoola, Group Managing Director/CEO of NGX Group, moderated the panel, highlighting how Nigeria’s reform agenda is repositioning the country as a credible and attractive investment destination.

“Today’s dialogue marks a pivotal step in reshaping global perceptions of Nigeria’s investment story,” said Popoola. “The candid engagement between policymakers, market participants, and investors signals the real progress Nigeria is making. At NGX, we remain committed to supporting reforms that deepen market infrastructure, spark innovation, and accelerate economic growth.”

While international investors welcomed Nigeria’s reform trajectory, they stressed the need for policy consistency—particularly on FX matters—alongside reduced transaction costs, regulatory clarity, and more decisive action on non-oil revenue diversification and ease of doing business.

The event closed on a hopeful note, with participants expressing confidence in Nigeria’s economic future—contingent on sustained reform momentum and continued transparency in fiscal and monetary policy communication.

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Telegram (Opens in new window) Telegram

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

You may like

NGX Group Reports N15.6bn 2025 Profit, Declares Full-Year Dividend

NGX Group Fuels Women’s Investment Drive, Engages 9,000 FinTrive Finance Fair 2025

How Policy Missteps Weigh Down Nigeria’s Fragile Banking Giants

Nigeria at 65: A Nation Still Waiting for a Banking Revolution

Nigeria’s Banking Woes: How One South African Bank Outvalues an Entire Industry

Nigeria Sustains Economic Expansion as PMI Rises to 52.7 Points in July