Analyst Insight

Nigeria’s Telecoms Sector Under Pressure as Broadband Connections Grow Modestly

Published

1 year agoon

By FBNQuest Analysts

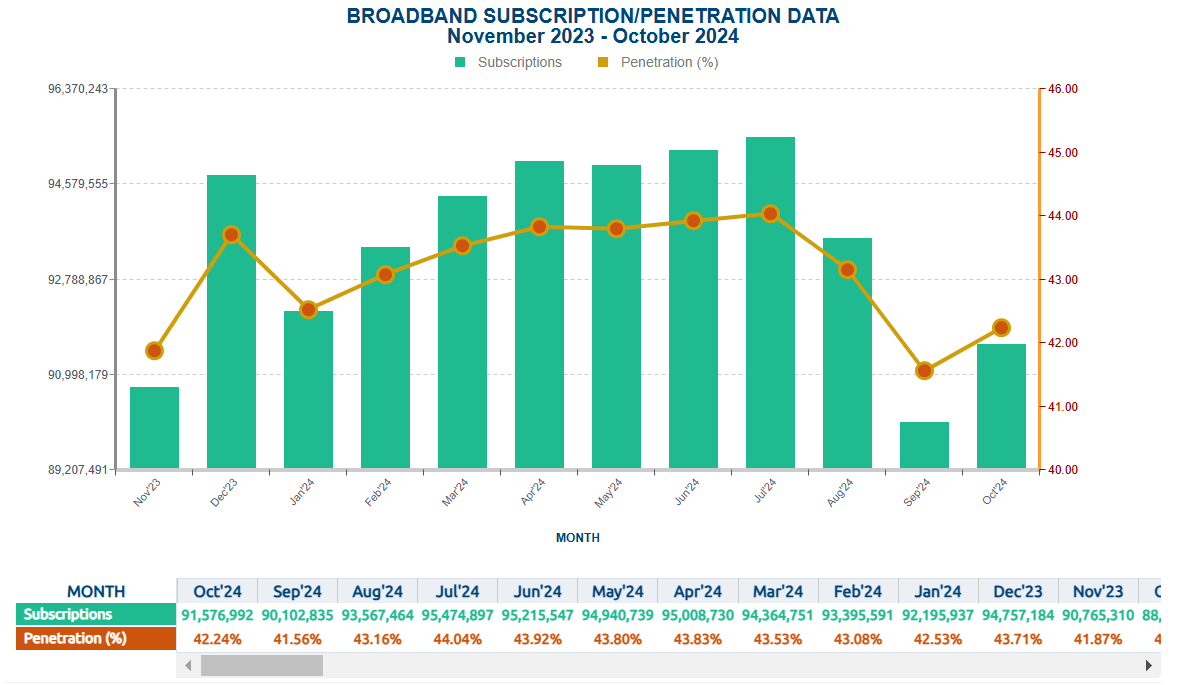

Recent data from the Nigerian Communication Commission (NCC) has shown that Nigeria’s total broadband connections increased by 2% month-on-month (MoM) to 91.6 million in October 2024.

Read Also:

This marks a rebound compared with the decline of -4% M-o-M recorded in the previous month. Consequently, the M-o-M increase in broadband subscriptions resulted in a higher broadband penetration rate of 42.2%, up from 41.6% in September.

Despite the modest growth, the current penetration rate of 42.2% remains far below the broadband penetration target of 70% set by the FG in the National Broadband Plan (NBP 2020-2025).

The slow pace of broadband growth can be attributed to significant infrastructural deficits, reduced investments, and persistent security challenges.

Notably, National Bureau of Statistic’s (NBS’s) most recent data on capital importation shows that foreign direct investment into the sector plummeted to $14.7 million in Q3 2024, implying marked reductions of -87% quarter-on-quarter (QoQ) and -77% year-on-year (YoY), further highlighting the concerning trend of declining investment in the sector.

The low level of foreign investment in the sector can be attributed to challenging operational headwinds, which have heightened operating expenses and negatively impacted profitability.

These challenges include naira volatility, rising inflationary pressures, high energy and lease costs, and elevated interest rates.

Consequently, the considerable reduction of investment in the sector has hindered network operators’ capacity to address infrastructural gaps and increase broadband coverage.

Network operators have consulted with the federal government and requested a potential tariff increase of approximately 100% to address rising operating expenses and maintain profitability.

Although Minister of Communications Bosun Tijani recently confirmed that a tariff increase is imminent, he suggested that it would be less than 100%.

The proposed hike on telecom services will further strain consumer wallets. However, it is required to address inflationary price pressures on input costs, sustain network investments, and ensure service quality (see chart below)

Share this:

- Click to share on X (Opens in new window) X

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Pocket (Opens in new window) Pocket

- Click to share on Telegram (Opens in new window) Telegram

- Click to email a link to a friend (Opens in new window) Email

- Click to share on LinkedIn (Opens in new window) LinkedIn

You may like

NCC to Rollout Satellite-to-Phone Technology for 23.3m Nigerians

Nigeria’s Inflation Decline to 15.15% in December 2025 Ignites Questions of Sustainability

Digital Inequality Widens as 77% of Rural Nigeria Remains Offline

Nigeria’s Economy at a Crossroads: Rising Debts, Eased MPR, and Cost to Citizens

JUST IN: Nigeria Posts 4.23% GDP Growth in Q2 2025

Nigeria’s Inflation Eases to 20.12% in August as Food Prices Retreat